These are some of the most uncertain times in the global economy. The World Health Organization (WHO) has declared the COVID 19 a pandemic and Prime Minister Narendra Modi has ordered a lockdown for 3 weeks to safeguard public health. As health care dominates the headlines, you must think through the consequences of this shutdown and what happens thereafter.

Once the lockdown is lifted and things get back to normal (the new normal, if I may !), there are plenty of financial challenges that businesses are likely to face. While the Government is trying to help tide over operational difficulties that may arise due to the closure, real business challenges are to be dealt with by entrepreneurs.

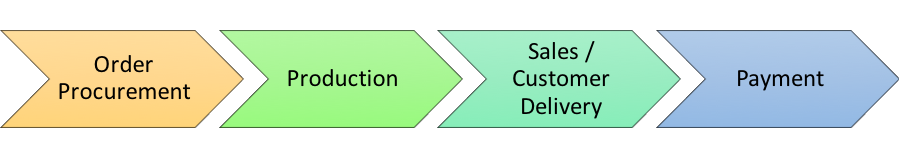

Each business is different, and yet the larger cycle remains alike.

Where is my cash?

Cash is King. It indeed is. While many different metrics are used to evaluate businesses, the true measure of it all is cash generation. In simple terms, whether your customers are paying you for the goods or services you have provided to them.

Let us say, you manufacture packing material for a mobile phone brand. You get your orders, plan your supply chain and manufacture and supply as per the schedule agreed with the brand.

As you invoice and despatch your products, you are booking your income and the income statement starts looking good. However, you need to pay the suppliers of the raw material, pay for electricity and rent of the manufacturing unit and yes pay rent to your employees. Where does this all come from? It comes from your customer – the mobile brand, and the chain moves forward.

When the mobile brand pays you for the goods sold to them, you not only generate cash enough to pay for goods and services consumed in manufacturing it, the excess, your profit, is what you will use to invest in future expansion and R&D.

So, what has changed now?

To begin with, the following is likely to happen:

- A drop in all new orders. Why? – because the mobile brand is not sure how many mobile phones, they will sell going forward

- Delay in purchasing existing inventory – This is stock packed and ready to despatch which they are asking to be deferred.

- Delay in clearing your dues – Your invoices may not be paid within 15 days as before. They need 60 days more!

- Your clock is running – you still need to pay salaries, rent, electricity, etc.

You are facing a cash crunch.

A cash crunch situation t0 address

- How to generate immediate cash

- Ways to reduce expenses and cash outflow

- How to deal with on-going investments, projects that are not currently yielding profits.

How much cash do you need?

Most enterprises monitor their cash flows carefully even in normal times and determine how much they need to borrow to fill the gap. This means you will have an idea of how much cash is in need every month to keep going. If you don’t have one, quickly make a budget for the next 6-12 months. The most uncertain part at this point is the revenue, so keep a good measure of your fixed costs.

Once you determine the minimum cash you need to keep going (cash burn), you will know how long you can sustain without any external assistance. All your actions must keep this timeline in mind.

How to generate immediate cash

One look at your finances, you will know your cash is majorly on the unsold inventory and receivables. In which the partial finance is by the supplier, hence to convert them into ready cash is the best way to overcome during this crisis. How to do that:

1.Accounts Receivable:

Yes, your customer has asked for an extended payment schedule, so he is unlikely to offer you any other assistance but do check if they are offering a cash discount to pay you early. Yes, this means eating into your profits, but it is still a great way to square things up.

Alternatively, check with the customer if they are offering any other financing option, like bill discounting from their banker. Larger companies do put in place such financing options, but unlikely if your customer is a small or medium-scale industry. Of course, here I am assuming you don’t already have a line of credit from your banker against these receivables. Setting up a new credit line at this point may be time-consuming with the requirement of substantial collateral.

A largely unexplored yet very interesting method of financing is peer2peer (P2P) lending. Many platforms have emerged and have financed such unpaid invoices. A more formal method of discounting /factoring of your receivables is to sell on TReDS platforms.

-

TReDS

TReDS is an online invoice discounting platform enabled by the RBI. The advantage of this platform is that the banks purchasing these receivables undertake the credit risk associated with the invoice. This ensures that the seller has no further obligation, unlike traditional discounting options offered by banks, which are in the nature of cash advances.

2. Inventory:

Unlike receivables, which apply to the manufacturing, trading and services industry, inventory is unique to manufacturing and trading. As a manufacturer with unsold finished goods, you are sitting on something that can be readily converted into cash. Generally, your relationship with the customer should help you tide over many of the challenges of delays and stockpile up.

If goods are generic and can be sold easily – the world is your market and go all out to find new customers (yes, that’s easier said than done in this environment, but think if you made customized products !). Consumer products are easier to sell than industrial, generic easier than customized and if you manufacture under a contract, then you are legally bound to hold it.

3. Sale and leaseback:

This won’t yield immediate cash, but one worth considering. To buy or lease is a classic capital budgeting problem. The right answer depends on a lot of factors – availability of cash, cost of capital and general perception of risk and investment.

In tough times though, one can not only defer all new buy proposals to lease but also look at selling current assets on the books and lease them back. All most all types of assets can be sold and leased back – machinery, office equipment, and even computers and mobile phones.

Few matters need attention to individual requirements and customize the options. Talk to us if you want details.

Ways to reduce expenses and cash outflow

1.Cutting Costs:

Whenever the business sentiment turns sour, the first step many consider is to cut costs. While it is always always a great idea to be cost-conscious and avoid frivolous costs, it does not really work that way.

Of course, every downturn also makes many costs redundant. Consider a certain business within your company is likely to see a big challenge going forward – what do you do? Some may consider reducing the workforce and associated costs, others may simply redeploy them.

Individual facts shall determine the decisions, but do consider the following :

- There are contract costs that are difficult to get out of without large penalties- rents, leases, guarantees

- The costs that impact employee morale like firing employees, salary cuts

- The administrative cost cuts that bring hardships – smaller offices, travel restrictions, etc

A golden rule for cost-cutting is not to renegotiate services and goods that are already purchased and consumed. No one likes to be on the receiving end of this one, and so don’t initiate it either.

However, be open to renegotiating on downsizing future commitments. Simple, if you are outsourcing certain activities and the scale of operations going down is likely to reduce their time to do it, renegotiate the deal.

Look through your expenses for the last year and the projections for the future. Discretionary spending – ones that really do not directly impact your performance should be axed first. You can cut the spends on travel, entertainment, and corporate gifting, etc

And if you are at the receiving end of one such order to reduce costs within your department, here is a short guide to help you through it.

2.Accounts Payable:

Role reversal time! Time to pay up for the raw material and services you availed. Yes, the first response is to do to them what your customers are doing – delay the payment. That is not a great idea. It Is easy to say, sorry we can’t pay now, but that there is a good chance that your suppliers are more vulnerable to such a financial shock than you are.

The tools for them to get cash on time is the same as you have. So, if you want an extension in payment, try and facilitate credit lines for them through your banking network or ensure that when they seek credit from their bank or financier you fully support that cause. Speak to your banker to extend vendor financing options to your vendors or encourage them to discount their receivables on TReDS like platforms.

Another important element to consider is the legal protection which many small and medium scale enterprises enjoy.Donot delay the payments which will be reported and will be blacklisted.

For fresh purchases, indicate forthwith that you are likely to scale back orders so that they will prepare and adjust their supplies accordingly. Timely communication can save a lot of financial hardship within the supply chain and avoid getting into financial distress.

3.How to deal with on-going investments, projects that are not currently yielding profits.

These are the toughest questions to answer. While the renewed scenario presents new business opportunities to you, the question is, does it make sense to commit cash to it? Does it make sense to continue pouring money into products that will yield revenue in a few years? A common thread amongst all such projects is also the uncertainty with the outcome.

Many software projects have already shifted to Agile methodology from the earlier waterfall, but that alone may not be adequate. Tweaking business requirements and adapting solutions to accelerate the development is necessary to conserve cash. Each business should decide how much cash to spend on these and may have to scrap some of the projects to retain others. There are many great reads on this topic, including this one on “How to succeed in uncertain times”

Conclusion

With the closure of businesses and the losses incurred, there will be huge pressure on cash flows as we restart. Set your priorities on how to tackle the next 6 – 12 months. Plan now, build scenarios and be prepared to face the challenges.